Eng

Download Incoterms 2020 Here

What are Incoterms® rules?

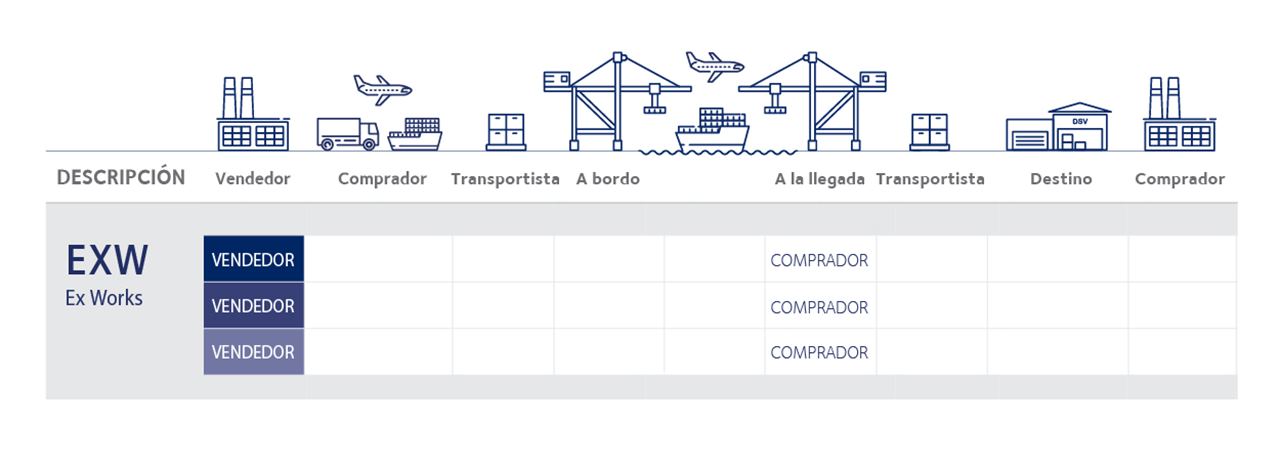

EXW – Ex Works – Ex works (+agreed place of delivery)

In Factory or Ex Works , the seller is only responsible for delivering the goods to its own or external facilities designated by it. Buyer bears all risk from there to destination. In Ex Works conditions, the seller makes the merchandise available to the buyer in its own premises but has no obligation to load the merchandise in the vehicle that comes to pick up the merchandise, nor will it dispatch the merchandise for export. The EXW incoterm® rule means the minimum obligation for the seller.

If the seller offers to load the merchandise on the pick-up vehicle, we recommend using the FCA (Free Carrier) rule as this Incoterm® rule obliges the seller to load the merchandise at their own risk and expense.

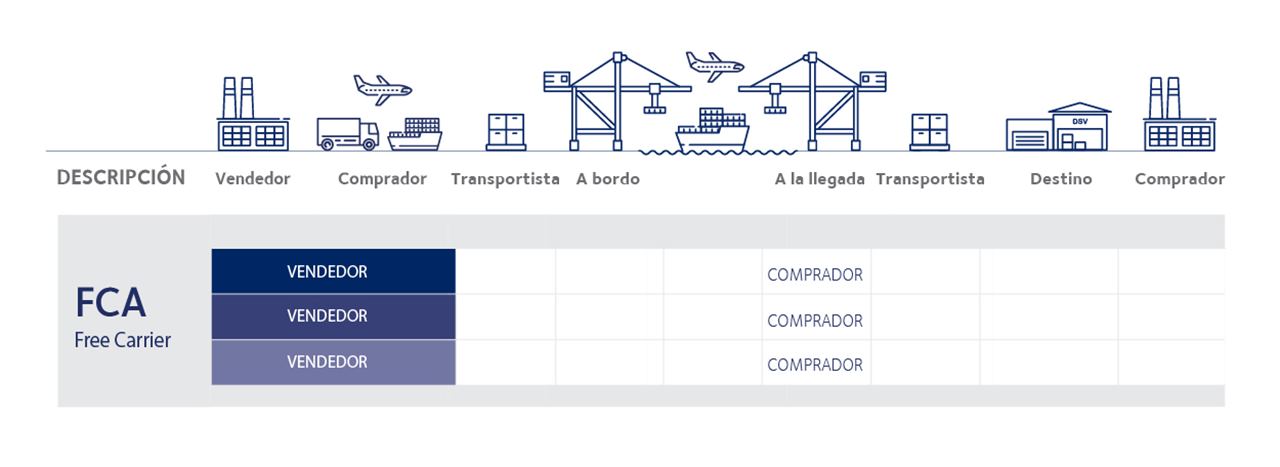

FCA – Free Carrier – Free Carrier (+agreed place of delivery)

“ Free Carrier ” is when the seller delivers the merchandise to the carrier (the person responsible for carrying out the freight) or another person designated by the buyer at the seller’s premises or at another agreed place. If the delivery point is at the seller’s facilities, the merchandise is delivered with its cargo in the means of transport arranged by the buyer. If the designated place is another, the merchandise is delivered when it is ready for unloading on the seller’s means of transport at the agreed point. It is recommended to specify in detail the point of the agreed place of delivery, since the risk is transferred to the buyer with the delivery of the merchandise.

The incoterm® FCA rule requires the seller to clear the goods for export, if applicable. However, FCA exempts the seller from any obligation to clear the merchandise for import, payment of import duties or import customs formalities.

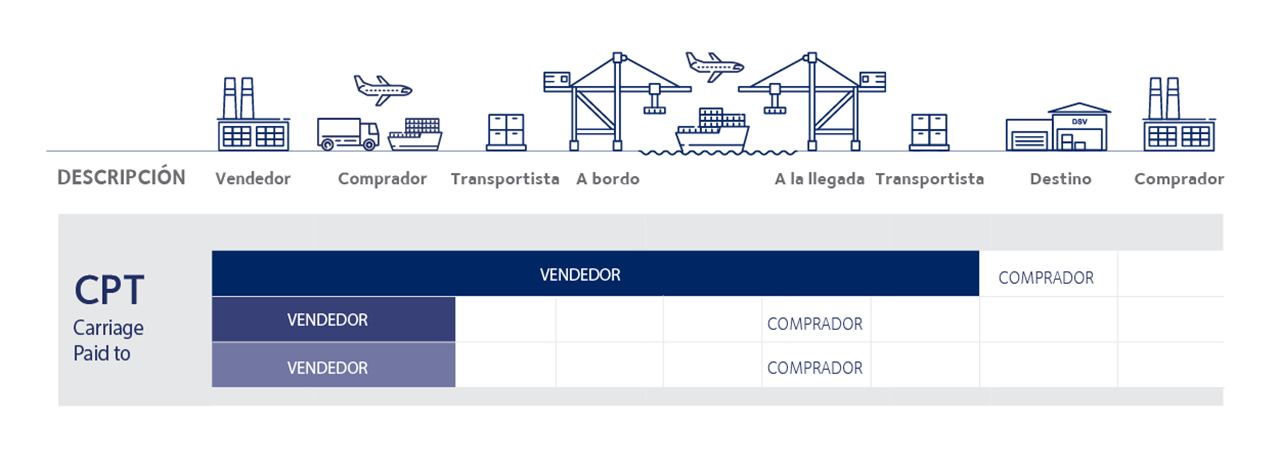

CPT Carrier Paid To – Carriage paid to (+agreed place of delivery)

“ Carriage Paid To ” is when the seller delivers the merchandise to the carrier (the person responsible for carrying out the freight) or another person designated by the seller at an agreed place. With this rule, the seller must contract and bear the transportation costs to bring the merchandise to the agreed place.

The seller pays for the transport to the agreed destination, but delivers the goods to the buyer (with transfer of risk) putting them in the possession of the carrier hired by said seller.

The incoterm® CPT rule requires the seller to clear the merchandise for export, if applicable. However, CPT exempts the seller from any obligation to clear the merchandise for import, payment of import duties or import customs procedures.

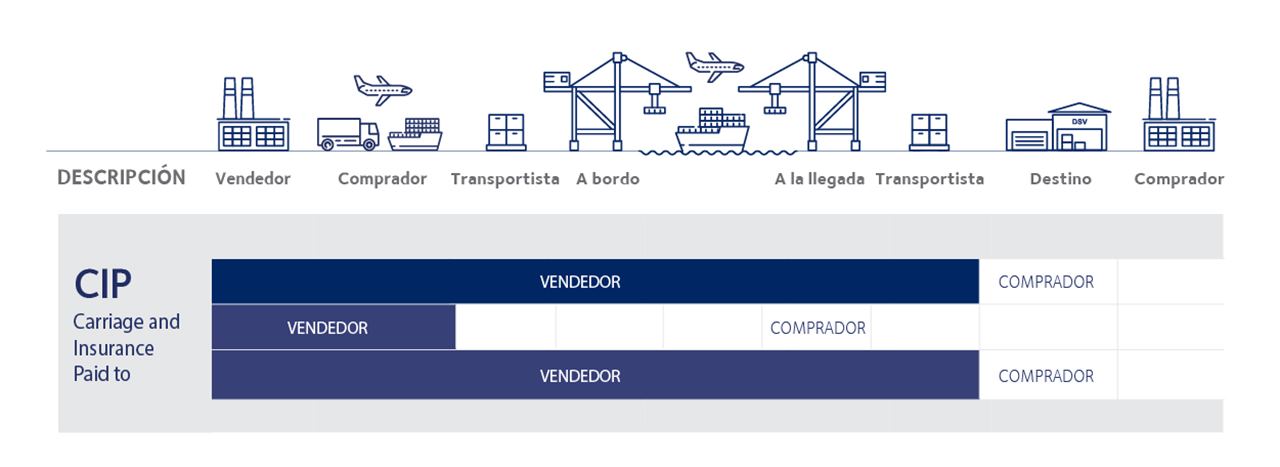

CIP – Carrier and Insurance Paid To – Transportation and Insurance paid to (+agreed place of delivery)

The seller pays for the transport to the agreed destination, but delivers the goods to the buyer (with transfer of risk) putting them in the possession of the carrier hired by said seller. This Incoterm requires the seller to take out insurance coverage under the ICCA conditions or similar.

In the Incoterm® CIP rule, the seller must set insurance coverage in compliance with the Institute’s Cargo Clauses (A) , although it is also available to the buyer and seller to agree on a lower level of coverage. In Incoterms 2010® limited insurance coverage was sufficient.

DAP – Delivered at Place – Delivered at place (+agreed place of delivery)

“ Delivered at Place ” is when the seller delivers the merchandise, with transfer of risk, when it is made available to the buyer in the means of transport prepared for unloading at the agreed destination. The seller bears all the risks of bringing the merchandise to the agreed place.

It is recommended to specify in full detail the agreed place of destination, since the risks up to that point are assumed by the seller. If you want the seller to clear the merchandise for import or carry out any import customs formality, you should use the Incoterm® DDP (Delivered Duties Paid) rule.

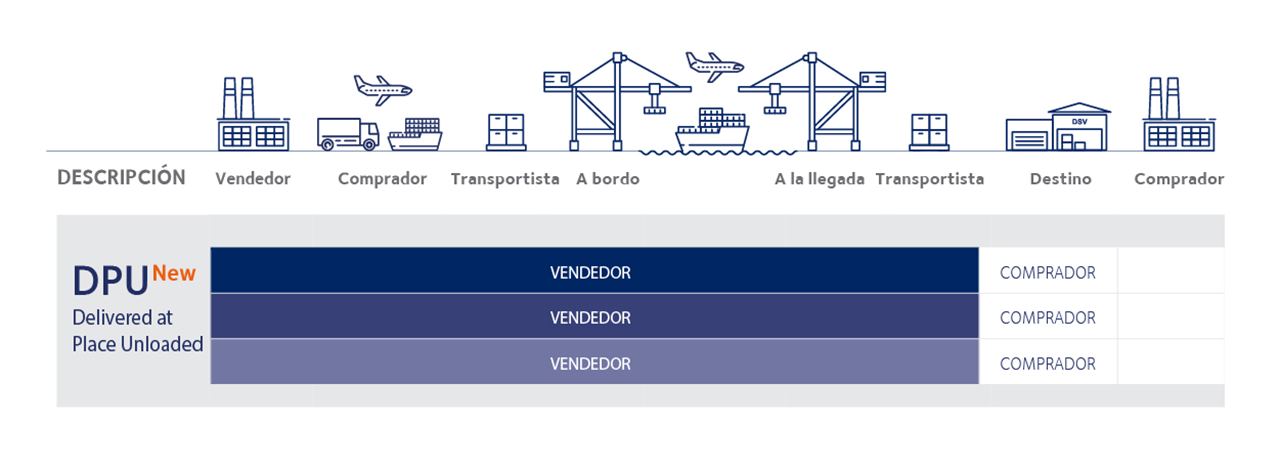

Delivered at Place Unloaded (DPU) – Merchandise delivered and unloaded at the agreed place

The Incoterm® DPU (Merchandise delivered and unloaded at the agreed place of delivery) establishes that the seller delivers the merchandise, with transfer of risk, when it, once unloaded from the means of transport, is made available to the buyer at the place of delivery. agreed destination.

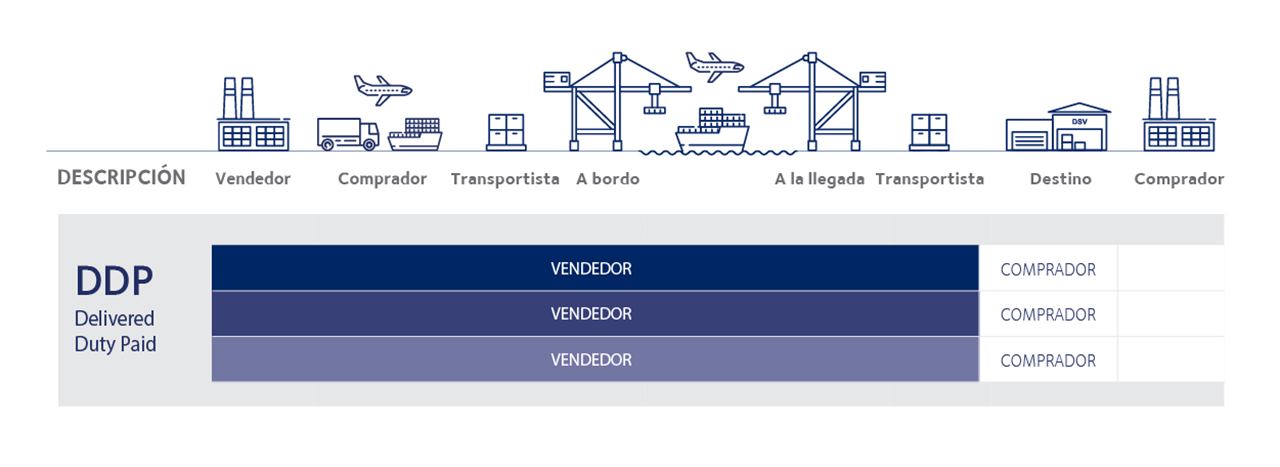

DDP – Delivered Duty Paid – Delivered Duty Paid (+agreed place of delivery)

“ Delivered Duties Paid ” is when the seller delivers the merchandise, with transfer of risk, when he makes it available to the buyer cleared for import in the means of transport ready for unloading at the agreed destination. The seller bears all the risks of bringing the merchandise to the agreed place and must clear the merchandise for both import and export, as well as carry out all related customs formalities.

The incoterm® DDP rule is the maximum obligation for the seller. It is recommended to specify in full detail the agreed place of destination, since the risks up to that point are assumed by the seller. If the seller cannot obtain import clearance, this rule is not used.

If you want the buyer to bear all the risks and costs of import clearance, it is recommended to use DAP (Delivered at Place).

Import taxes payable, such as VAT, will be borne by the seller.

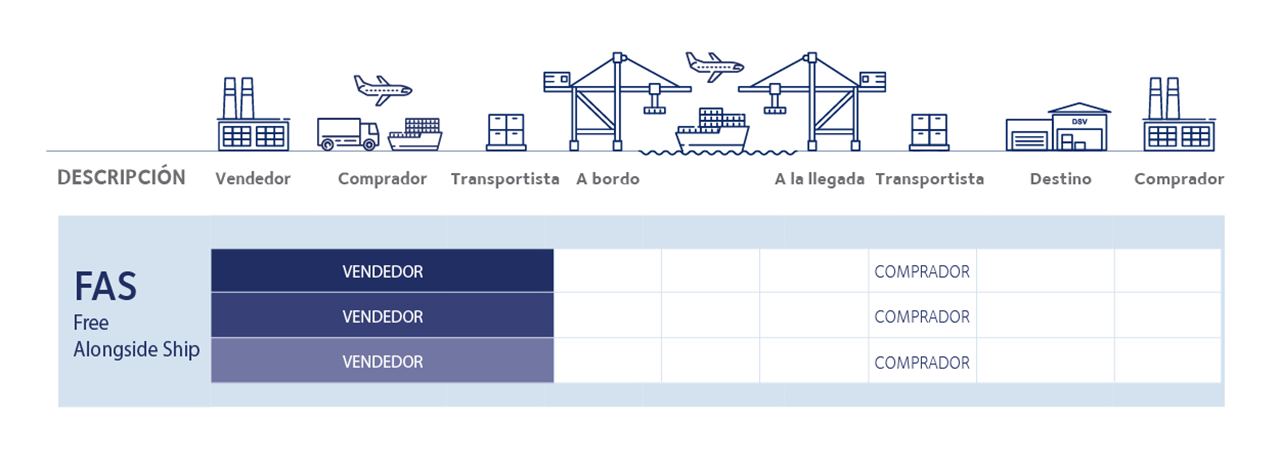

FAS – Free Alongside Ship – Free Alongside Ship (+agreed place of delivery)

“ Free Alongside Ship ” is when the seller delivers the goods to the buyer when the goods are placed alongside the ship (or barge) designated by the buyer at the port of shipment. From this point, the risk is assumed by the buyer.

It is recommended to specify in full detail the point of loading at the agreed port of shipment, since the risks and costs up to that point are assumed by the seller.

When the merchandise must be grouped or consolidated in containers, the seller delivers it to the carrier at a container terminal. From that moment, the seller loses control of the merchandise and it goes through multiple movements to be grouped in a container. When this happens, it is recommended to use the Incoterm® FCA (Free Carrier) rule.

The incoterm® FAS rule requires the seller to clear the merchandise for export, if applicable. However, FAS exempts the seller from any obligation to clear the merchandise for import, payment of import duties or import customs procedures.

When the merchandise must be grouped or consolidated in containers, the seller delivers it to the carrier at a container terminal. From that moment, the seller loses control of the merchandise and it goes through multiple movements to be grouped in a container. When this happens, it is recommended to use the Incoterm® FCA rule.

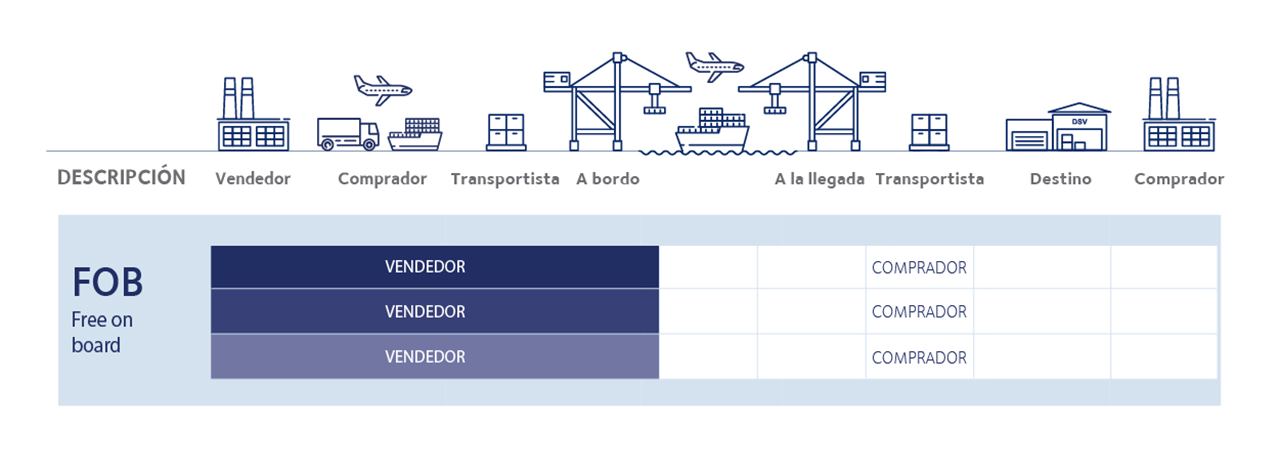

FOB – Free On Board – Free on Board (+agreed place of delivery)

“ Free on Board ” is when the seller delivers the merchandise on board the vessel designated by the buyer at the port of shipment. The risk is transmitted when the goods are on board the ship.

It is recommended to specify in full detail the point of loading at the agreed port of shipment, since the risks and costs up to that point are assumed by the seller.

When the merchandise must be grouped or consolidated in containers, the seller provides the same to the carrier at a container terminal. From that moment on, the seller loses control of the merchandise, which undergoes several movements to be grouped in a container. When this happens, it is recommended to use the Incoterm® FCA (Free Carrier) rule.

The FOB incoterm® rule requires the seller to clear the merchandise for export, if applicable. However, FOB exempts the seller from any obligation to clear the merchandise for import, payment of import duties or import customs procedures.

In the Incoterm® FAS, FCA and FOB rules, the seller delivers the merchandise to a means of transport chosen by the buyer.

At the time the merchandise is grouped or consolidated into containers, the seller delivers it to the carrier at a container terminal. From there, the seller loses control of the merchandise, which goes through multiple movements to be grouped in a container. In this situation, it is recommended to use the Incoterm® FCA rule.

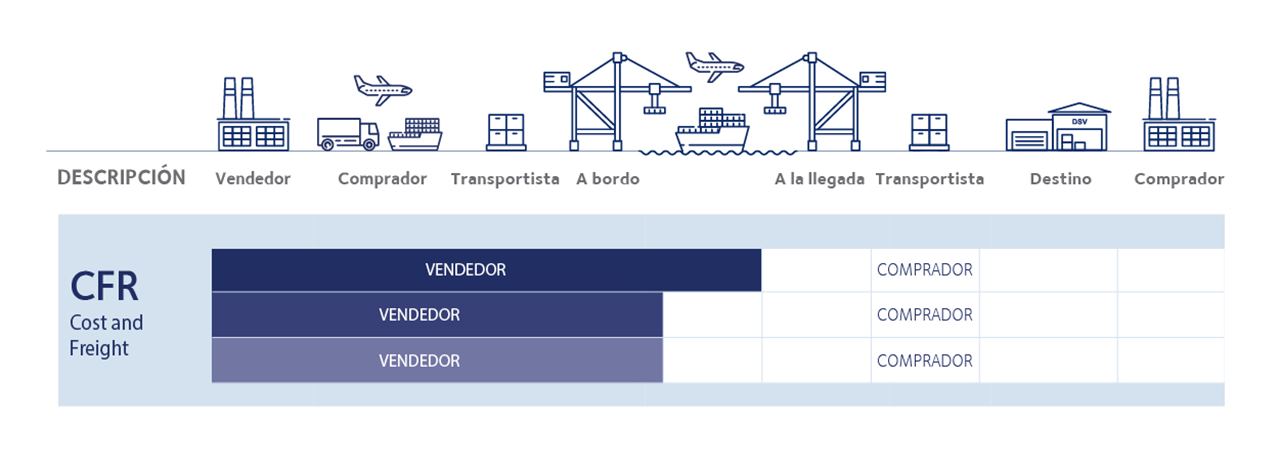

CFR – Cost and Freight – Cost and Freight (+agreed place of delivery)

“ Cost and Freight ” is when the seller assumes the cost and freight, duties not paid, to the agreed port of destination. Delivery occurs and the risk passes when the goods are on board the ship.

When the merchandise is grouped or consolidated in containers, the seller provides it to the carrier at a container terminal. From that moment on, the seller loses control of the merchandise, which undergoes several movements to be grouped in a container. When this happens, it is recommended to use the Incoterm® CPT rule.

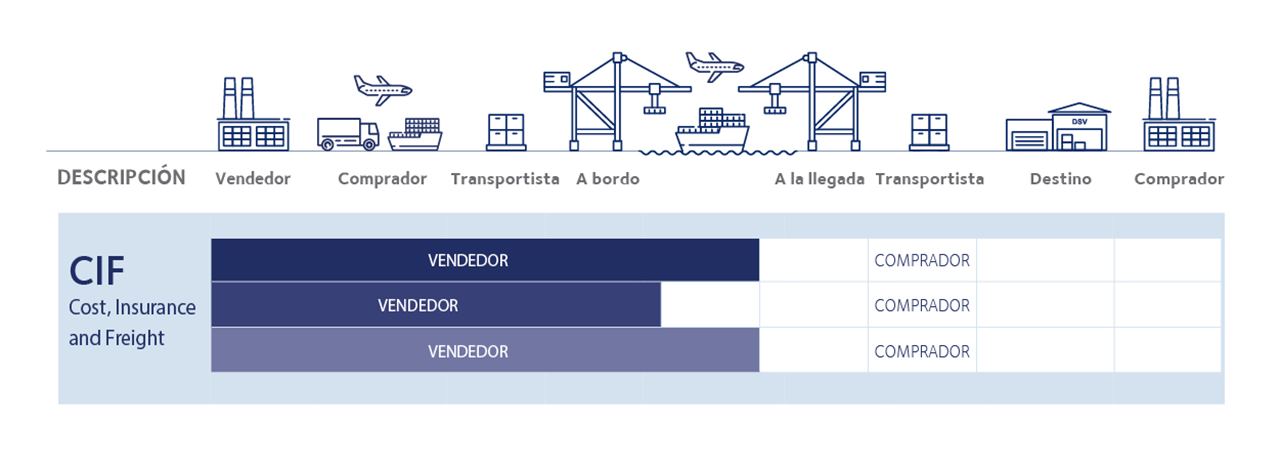

CIF – Cost, Insurance and Freight – Cost, Insurance and Freight (+agreed place of delivery)

With the CIF Incoterm®, the seller assumes the cost of insurance and freight, duties not paid, to the agreed port of destination. Delivery occurs and the risk passes when the goods are on board the ship. This Incoterm requires the seller to take out limited insurance cover under ICCC conditions or similar.

In the Incoterm® CIF rule, used mainly for the trading of raw materials, the Institute’s Load Clauses (C) are kept in their default position, leaving it to negotiation between buyer and seller to agree on a higher coverage.

What are Incoterms® rules?

Incoterms® are rules created by the ICC (International Chamber of Commerce), internationally recognized, that define rights and obligations between buyer and seller and establish how the costs and risks will be allocated between the different parties of a transaction. More information here .

Incoterms® 2020 tips: How to use them properly

- Agree the specific Incoterm® rule with the other party before shipping

- Verify that the Incoterm® rule used is suitable for the mode of transport of the operation and specify the place of delivery as EXACT as possible and the place of transmission of the risk when both places are different

- Confirm that both parties understand the responsibilities outlined in the sales contract

- Correctly indicate the agreed Incoterm® rule on the commercial invoice of the shipment

- Periodically check the Incoterms® rules used and revise them if necessary

- Choose Incoterms® that allow us to control merchandise and costs (EXW – FAS – FCA – FOB purchases // CFR – CIF – CPT – CIP – DAT – DAP – DDP sales)

- Specify place or port of delivery as EXACT as possible, (FCA SAN JOSE = NO // FCA RexLogística, SA, Metropolitan Free Zone Industrial Park, Building 3-33 = YES)

- Specify concisely and clearly the place of delivery and place of transmission of the risk when both places are different (CFR – CIF – CPT – CIP)

In any case, the Incoterms® rules are the work of the International Chamber of Commerce and it is their official version that should be referred to in case of any discrepancy.

8 key points to keep in mind before carrying out an international trade operation

1. Place and date of departure of the merchandise

2. Place and date of receipt of the merchandise

3. Quantities to be transported

4. Amount of the goods

5. What type of transport will be used to ship the merchandise

6. What appropriate packaging and labeling measures, as well as security measures must be taken into account so that the merchandise arrives in perfect conditions at its final destination

7. Which party must bear the different fees to be paid (customs) and insurance

8. Which party should be responsible for each of the necessary stages from the moment the merchandise leaves the place of origin until it reaches its final destination?

Main changes between Incoterms® 2010 and Incoterms® 2020 in Spanish

There are several key changes to the new Incoterms® 2020 rules compared to the 2010 ICC edition :

- DAT – Delivered at Terminal – Delivered at the terminal (+agreed place of delivery) is renamed Delivered at Place Unloaded (DPU) – Merchandise delivered and unloaded at an agreed place . The ICC (International Chamber of Commerce) states that the name of the DAT rule has been changed to the new Incoterms® rule DPU (Goods Delivered and Unloaded at Agreed Place of Delivery) to emphasize that the place of destination could be any place and not just a “terminal”. Although if the place of destination is not in a terminal, the seller should check that the merchandise can be unloaded at the place where it is planned to be unloaded.

- FCA – Free Carrier – Free Carrier (+agreed place of delivery) / DAP – Delivered at Place – Delivered at place (+agreed place of delivery) / DPU – Delivered at Place Unloaded : These Incoterms rules now take into account that the buyer and the seller can carry out the transport on their own with their own means of transport instead of hiring a third party carrier. In the Incoterms® 2010 rules it was assumed that the shipment made from the seller to the buyer was always done by a third party contracted for this purpose, so the Incoterms® 2020 rules make it clear that other situations exist.

- Also, the Incoterm® rule DAP , where delivery occurs before unloading, now appears before DPU .

- FCA – Free Carrier – Free Carrier (+agreed place of delivery) now allows Bills of Lading (bills of lading) to be issued after loading the merchandise. When goods are sold under FCA conditions for transport by sea, the selling or buying companies can request a bill of lading with the mention “on board”. The carrier, under its contract of carriage, may be required and empowered to issue a Bill of Lading on board only when the merchandise is actually on board.

In addition, there are other major changes to the ICC Incoterms®:

- CIF – Cost, Insurance and Freight – Cost, Insurance and Freight (+agreed place of delivery) and CIP – Carrier and Insurance Paid To – Transport and Insurance paid to (+agreed place of delivery): These terms establish new agreements at the level of different minimum insurance coverage of the merchandise, although the level of insurance remains negotiable between the buyer and the seller.

- When so stated, the allocation of costs between the buyer and the seller is expressed more precisely and more extensively . On the new Incoterms® 2020 rules, the costs now appear in article A9 / B9 of each Incoterm® rule. This change has been made in order to provide users with a single list of costs, so that the selling or buying company can find all the costs for which they would be responsible in one place.

- Security – level obligations now have a more prominent position . These obligations, linked to the transport requirements, have been moved to articles A4 and A7 of each Incoterm® rule.

- “Explanatory Notes for Users” for each Incoterm® rule replace the Guidance Notes of the 2010 edition, being easier for users. Explanatory notes for users describe the basics of each Incoterms® 2020 rule: when it should be used, when the risk passes and how the costs are shared between the selling and buying companies.

.png?rev=f43038cc7df7421aa4b39b00a3ca17c1&w=1920)